Enhance Financial Stability With Proactive GBP Monitoring Methods

In the world of international organization, the administration of GBP exposure is a vital component for guaranteeing financial stability and mitigating prospective risks. These strategies are just the idea of the iceberg when it comes to GBP risk administration.

Recognizing GBP Direct Exposure Threats

To efficiently manage financial stability, it is critical to comprehensively understand the inherent threats related to GBP direct exposure. The British Pound (GBP) is among the most commonly traded money worldwide, making it a crucial element of numerous investment portfolios and company purchases. Nonetheless, GBP direct exposure includes its own collection of risks that can considerably affect monetary end results.

Adjustments in rate of interest prices can affect financial investment returns, borrowing prices, and general economic efficiency for entities with GBP exposure. By evaluating and preparing for these individuals, organizations and dangers can implement reliable strategies to minimize potential losses and optimize monetary stability in the face of GBP exposure challenges.

Implementing Dynamic Hedging Methods

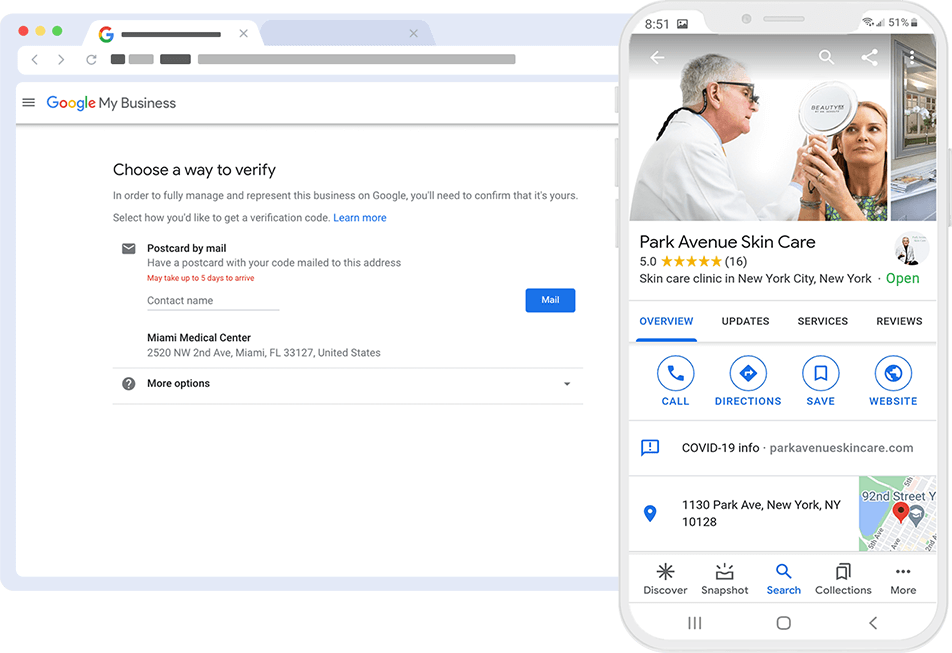

Offered the integral threats related to GBP direct exposure, a strategic technique to financial security includes the application of dynamic hedging techniques. Dynamic hedging is an aggressive risk monitoring approach that adjusts the bush ratio routinely based upon market conditions. google business profile management. By continually checking and reassessing the threat exposure, business can adapt their hedging positions to show any adjustments in the GBP currency exchange rate, thus minimizing prospective losses

One trick facet of vibrant hedging is making use of various economic instruments, such as options and futures contracts, to hedge against adverse currency activities. These instruments supply flexibility and allow companies to react promptly to market fluctuations. Furthermore, vibrant hedging enables a much more customized approach to hedging, making sure that the defense aligns closely with the certain risks faced by the organization.

Leveraging Money Options for Defense

Purposefully leveraging currency options can give effective security versus GBP direct exposure risks in today's unstable market atmosphere. Money alternatives supply the holder the right, however not the responsibility, to trade a defined quantity of one currency for one more at a predetermined currency exchange rate prior to the alternative's expiry date. This versatility enables organizations with GBP direct exposure to mitigate possible losses caused by unfavorable exchange rate motions.

Utilizing Forward Contracts Strategically

When handling GBP direct exposure threats, including ahead agreements into your economic strategy can provide a proactive strategy to hedging versus negative currency exchange rate movements. Forward contracts make it possible for businesses to secure a details currency exchange rate for a future day, hence reducing the uncertainty associated with rising and falling money worths. By using ahead contracts purposefully, firms can safeguard their revenue margins, improve financial security, and prevent potential losses resulting from unfavorable money changes.

One key advantage of utilizing forward contracts is the capacity to prepare ahead with assurance concerning future cash streams in different money. This permits services to accurately forecast their economic performance and make informed decisions without being exposed to the volatility of the forex market. Additionally, onward contracts give a level of adaptability, as companies can personalize the agreement terms to suit their details hedging requirements.

Surveillance and Adapting Threat Administration Practices

Reliable risk monitoring rests on the continual tracking and adaptation of well-known methods to straighten with advancing market problems and internal characteristics. In the world of managing GBP direct exposure, remaining attentive to changes in money values and changing threat management methods appropriately is paramount. On a regular basis assessing the efficiency of hedging systems, such as alternatives and forward contracts, is vital to guarantee that they stay in accordance with the company's risk resistance and financial objectives.

Additionally, monitoring macroeconomic indicators, geopolitical events, and central financial institution policies that impact GBP exchange rates can supply beneficial understandings for refining risk administration techniques. By remaining educated concerning market fads and upcoming growths, blog here business can proactively change their threat reduction strategies to take advantage of and reduce prospective losses on chances.

In addition to outside variables, internal procedures and treatments need to likewise be subject to ongoing evaluation. Conducting routine testimonials of danger management frameworks and methods can aid determine areas for improvement and improve the general effectiveness of GBP risk reduction approaches. By promoting a culture of versatility and constant improvement, companies can boost their monetary stability and resilience in the face of money changes and market uncertainties.

Conclusion

In conclusion, aggressive management of GBP direct exposure dangers is crucial for boosting monetary security. By applying vibrant hedging methods, leveraging currency alternatives, utilizing onward agreements tactically, and continuously keeping track of and adjusting danger management techniques, companies can better secure themselves from fluctuations in the GBP currency exchange rate. It is important for companies to stay versatile and proactive in managing their money dangers to ensure long-lasting economic stability and success.

In the world of international service, the management of GBP direct exposure is a vital part for making sure economic stability and mitigating possible threats. Political events, financial signs, and market conjecture all add to the volatility of the GBP exchange rate, highlighting the demand for a thorough understanding of these variables when handling GBP direct exposure.

When handling GBP direct exposure threats, including onward contracts right into your monetary method can give a proactive my latest blog post method to hedging against negative exchange rate movements. Conducting regular evaluations of danger monitoring frameworks and procedures can assist determine locations for renovation and boost the general performance of GBP threat reduction strategies.In conclusion, proactive management of GBP direct exposure risks Get More Information is necessary for boosting monetary security.

Comments on “Why Pick LinkDaddy for Your GBP Management Demands?”